SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☒ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 | |

WESTERN DIGITAL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | Fee not required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Stockholder Update Fall 2020

Forward-Looking Statements This presentation contains forward-looking statements that involve risks and uncertainties, including, but not limited to, statements regarding the company’s product portfolio and growth opportunities, as well as expectations regarding our CEO’s future performance, market growth and industry trends. Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by, which performance or results will be achieved, if at all. Forward-looking statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Key risks and uncertainties include future responses to and effects of the COVID-19 pandemic; volatility in global economic conditions; business conditions and growth in the storage ecosystem; impact of restructuring activities and cost saving initiatives; impact of competitive products and pricing; market acceptance and cost of commodity materials and specialized product components; actions by competitors; unexpected advances in competing technologies; our development and introduction of products based on new technologies and expansion into new data storage markets; risks associated with acquisitions, divestitures, mergers and joint ventures; difficulties or delays in manufacturing; the outcome of legal proceedings; and other risks and uncertainties listed in the company’s filings with the Securities and Exchange Commission (the “SEC”) and available on the SEC’s website at www.sec.gov, including our most recently filed periodic report, to which your attention is directed. We do not undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

Headquarters: San Jose, CA Employees: ~64,000 Patents: ~13,500 Revenue: $16.7 Billion1 Addressable Market: $65 Billion in 2019 to $128 Billion by 20252 Global Data Infrastructure Leader The ongoing digital transformation is reshaping companies across every industry and how we live our daily lives. This transformation is significantly increasing the amount of data generated, stored and consumed – driving a vast, multi-year growth opportunity. Western Digital’s flash and hard drive products are foundational to this digital transformation, enabling rapid growth in the volume, velocity and value of data. Everywhere data lives, from cloud data centers to mobile sensors and personal devices on the edge, our industry-leading storage solutions deliver the possibilities of data. 1FY2020. 2 Source: WDC internal estimates

Thorough Independent Approach The Board appointed a special search committee led by Stephanie Streeter to oversee the CEO search process The Board also engaged a leading executive search firm to assist in the process, and identified a diverse pool of external and internal candidates to evaluate Search Focused on Key Skills and Experience Proven track record of operating successfully at scale Ability to define and execute on a growth strategy driven by innovation, operational excellence, and world-class talent development Proven business experience and deep technical knowledge Successful Leadership Transition In October 2019, we announced that Stephen Milligan intended to retire as CEO To ensure a seamless transition, Mr. Milligan agreed to serve as CEO until the appointment of his successor, and remained with the Company in an advisory role until September 2020 19 years at Cisco, most recently EVP and General Manager of Networking and Security Business, a $34B global technology franchise; led team of 25,000+ engineers Oversaw Cisco’s networking and security strategy and market acceleration, including development operations for expansive technology portfolio and strategic acquisitions Instrumental in defining Cisco’s threat-centric security strategy, transitioning business to a software & recurring revenue model, returning business to share-gaining growth David Goeckeler Chief Executive Officer Appointed March 2020 Robust Search Process to Identify New CEO CEO Transition Strong leadership to address COVID-19 complexities. David provided immediate leadership to ensure business and operational continuity for our customers and to prioritize the health and safety of our employees. Strategic reorganization of company into dedicated flash and HDD business units. Each business unit will focus on portfolio strategy, product development, engineering and product management while leveraging common go-to-market and operational functions. Immediate Leadership Impact

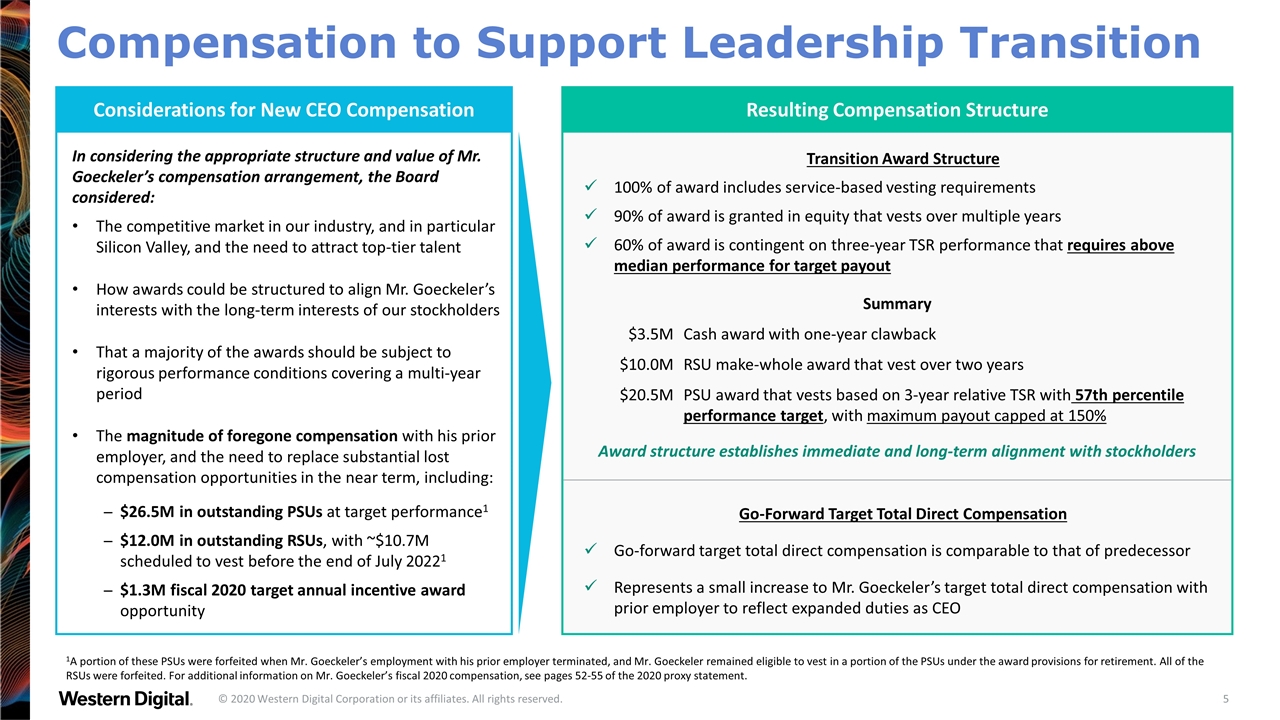

In considering the appropriate structure and value of Mr. Goeckeler’s compensation arrangement, the Board considered: The competitive market in our industry, and in particular Silicon Valley, and the need to attract top-tier talent How awards could be structured to align Mr. Goeckeler’s interests with the long-term interests of our stockholders That a majority of the awards should be subject to rigorous performance conditions covering a multi-year period The magnitude of foregone compensation with his prior employer, and the need to replace substantial lost compensation opportunities in the near term, including: $26.5M in outstanding PSUs at target performance1 $12.0M in outstanding RSUs, with ~$10.7M scheduled to vest before the end of July 20221 $1.3M fiscal 2020 target annual incentive award opportunity Transition Award Structure 100% of award includes service-based vesting requirements 90% of award is granted in equity that vests over multiple years 60% of award is contingent on three-year TSR performance that requires above median performance for target payout Award structure establishes immediate and long-term alignment with stockholders Go-Forward Target Total Direct Compensation Go-forward target total direct compensation is comparable to that of predecessor Represents a small increase to Mr. Goeckeler’s target total direct compensation with prior employer to reflect expanded duties as CEO Compensation to Support Leadership Transition Resulting Compensation Structure Considerations for New CEO Compensation Summary $3.5M Cash award with one-year clawback $10.0M RSU make-whole award that vest over two years $20.5M PSU award that vests based on 3-year relative TSR with 57th percentile performance target, with maximum payout capped at 150% 1A portion of these PSUs were forfeited when Mr. Goeckeler’s employment with his prior employer terminated, and Mr. Goeckeler remained eligible to vest in a portion of the PSUs under the award provisions for retirement. All of the RSUs were forfeited. For additional information on Mr. Goeckeler’s fiscal 2020 compensation, see pages 52-55 of the 2020 proxy statement.

We contacted stockholders holding greater than 45% of shares outstanding in each of the last three years to offer engagements Over the past year, we reached out to over 30 of our stockholders representing approximately 60% of shares outstanding. We conducted calls with 14 of our top 25 holders, as well as several other holders, composed of investors with a variety of investment styles and geographic locations Our ongoing stockholder engagement includes director participation and helps inform our compensation practices Extensive, board-driven stockholder engagement helped shape and continues to influence compensation program design Engagement Helps Inform Compensation Design We reached out to stockholders representing over: Our engagement included: Lengthened performance period for our STI program and diversified metrics Lengthened performance and vesting period for PSUs Introduced standalone relative TSR metric for PSUs and capped payout at target in case of negative absolute TSR These changes were viewed positively by investors and we further refined our program in fiscal 2021 to reflect investor feedback (as detailed on the following page) Stockholder Feedback Led to Meaningful Compensation Changes in Recent Years

Pay Element Vehicle Measurement Period Performance Link Base Salary Cash Competitive with market/industry practices; adjusted for experience, responsibility, potential and performance Short-Term Incentives Cash One year Non-GAAP Operating Income (50%) better reflects core operations by excluding taxes and interest Exabytes Shipped (25%) provides tangible operational milestones Individual Performance (25%) allows for differentiation based on individual contributions Long-Term Incentives PSUs CEO (60%) Other NEOs (50%) All PSUs subject to 3-year vesting 100% based on 3-year performance reflects stockholder feedback Relative TSR (50%) based on S&P 500 constituents creates measure against broader equity market Revenue (25%) Non-GAAP EPS (25%) Pre-established relative MPA for financial metrics TSR-based awards capped at 100% if absolute TSR is negative RSUs CEO (40%) Other NEOs (50%) Pro-rata vesting over four years Stock price performance Executive Compensation Design Evolution Our compensation program aligns performance with pay results 2021 Executive Compensation Overview Pay Element Vehicle Measurement Period Performance Link Base Salary Cash Competitive with market/industry norms; adjusted for experience, responsibility, potential and performance Short-Term Incentives Cash One year Non-GAAP Net Income Long-Term Incentives PSUs CEO (60%) Other NEOs (50%) All PSUs subject to 3-year vesting 87.5% based on 3-year performance 12.5% based on 2-year performance Relative TSR (50%) based on custom peer group Revenue (25%) Non-GAAP EPS (25%) Pre-established relative Market Performance Adjustment (MPA) for financial metrics TSR-based awards capped at 100% if absolute TSR is negative RSUs CEO (40%) Other NEOs (50%) Pro-rata vesting over four years Stock price performance 2020 Executive Compensation Overview = Indicates new feature

Experienced Board Provides Strong Oversight Our Board is highly engaged and well-qualified, with diverse skillsets to effectively oversee our business strategy 1Calculation includes Paula Price's tenure as a director from July 2014 to February 2019 Gender Diversity Women in Board Leadership Roles: Lead Independent Director Audit Committee Chair Governance Committee Chair Kimberly Alexy Audit Committee Chair Director since 2018 Principal, Alexy Capital Management Deep expertise in finance, securities and corporate governance at several financial institutions and publicly held companies Age Balanced Board Tenure1 <5 years 5-10 years >10 years Average Tenure: 7.2 Years1 Martin Cole Compensation and Talent Committee Chair Director since 2014 Former Chairman & CEO of Cloudera and Former Group CE - Technology of Accenture Extensive senior executive leadership experience across a variety of business sectors and geographies Kathleen Cote Lead Independent Director Director since 2001 Former CEO of Worldport Communications, Inc. Seasoned executive with numerous years of experience overseeing global companies focused on technology and operations Tunç Doluca Director since 2018 President & CEO of Maxim Integrated Over 30 years of executive leadership and technical experience in the semiconductor industry David Goeckeler CEO of Western Digital Director since 2020 20 years in technical and leadership positions at Cisco and current role as Chief Executive Officer contributes indispensable knowledge Paula Price Director since June 2020 (former director from July 2014 to February 2019) Advisor to and Former EVP & CFO of Macy’s Inc. Veteran financial leader with a deep knowledge of the data-driven strategies transforming consumer businesses NEW Matthew Massengill Independent Chairman of the Board Director since 2000 Former President & CEO of Western Digital Many years as a Western Digital executive and Board member provide extensive experience directly relevant to our business Stephanie Streeter Governance Committee Chair Director since 2018 Former CEO of Libbey Inc. Extensive senior executive leadership experience overseeing companies with manufacturing and operations across the globe

2020 Annual Meeting Western Digital values your support on the 2020 ballot items Our Board recommends: A vote FOR Proposal 1 to elect each of the eight director nominees named in the proxy statement A vote FOR Proposal 2 to approve on an advisory basis the compensation of the Company’s named executive officers A vote FOR Proposal 3 to approve the amendment and restatement of the 2017 Performance Incentive Plan A vote FOR Proposal 4 to ratify the appointment of KPMG LLP as our independent registered public accounting firm for fiscal 2021